Apple Pay and US-exclusive Apple Card could expand to India

Apple is reportedly holding talks with local banks about ways to co-brand and launch the Apple Card in India, a 1.4 billion people country.

Moneycontrol reports that Apple is reportedly discussing with financial institutions in India to eventually launch the Apple Card in the Indian market.

It’s unclear if the talks are progressing or stalling. Apple may need to get creative, as only banks are permitted to issue credit cards in India.

Apple’s support document lists countries and regions where Apple Pay is currently available. The company’s iOS Feature Availability page shows that the Apple Card is presently a US-only affair, but the company will update it when availability expands.

When will Apple Card and Apple Pay arrive in India?

The Apple Card launched in August 2019 in partnership with Goldman Sachs but is yet to venture outside the United States. Apple Pay was released in October 2014 as a US-exclusive contactless payment system, expanding later to non-US markets.

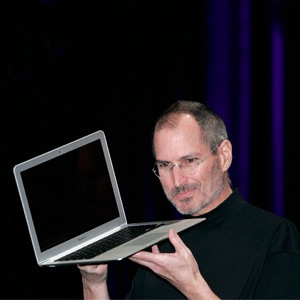

Both services could launch in India because the report claims that Tim Cook’s trip to India in April saw him meet with HDFC Bank CEO and MD Sashidhar Jagdishan. The publication reports that Cook has floated the idea of partnering with HDFC Bank to launch the Apple Card in India as a co-branded product.

The report doesn’t make it clear if the talks are still underway or when Apple is hoping to bring the Apple Card to India, but watch this space to stay in the loop.

While it might surprise you that Apple is prioritizing India over Europe or Japan for an Apple Card launch, the report notes that the company currently doesn’t even accept card payments in the country.

The specifics of banking and mobile payments in India

In India, the Unified Payments Interface (UPI) allows customers to make mobile payments by scanning QR codes on their phones. UPI also powers most App Store purchases, excluding iCloud services like storage and music.

Now, the outlet has learned that Apple held talks with the Reserve Bank of India (RBI) on the “modalities” of the card. The regulator insists that third-party websites store credit card details in a tokenized form that cannot be compromised and that payment data be only stored on Indian servers.

Thank you Prime Minister @narendramodi for the warm welcome. We share your vision of the positive impact technology can make on India’s future — from education and developers to manufacturing and the environment, we’re committed to growing and investing across the country. pic.twitter.com/xRSjc7u5Ip

— Tim Cook (@tim_cook) April 19, 2023

The suggestion at the meeting that Apple takes customer permission through one-time passwords meant that “UPI was more seamless for Apple customers..”

Sources say the regulator doesn’t want to give Apple preferential treatment, asking it to follow the regular procedure for co-branded credit cards instead.

India has a population of 1.4 billion people, representing a significant opportunity for Apple Card and Apple Pay, neither of which are available in India.

Source link: https://www.idownloadblog.com/2023/06/23/appel-card-india-expansion-rumor/

Leave a Reply