Apple Pay Later is shutting down, but third-party loans are coming to iOS 18

Apple’s buy-now-pay-later service is being discontinued after less than a year, but third-party installment loans will be coming to Apple Pay with iOS 18 this fall.

On June 17, Apple issued a press statement confirming that its in-house Apple Pay Later service is being discontinued in favor of third-party loans in iOS 18. Those with existing loans can continue paying them off and manage them in the Wallet app.

But don’t worry, Apple Pay on iOS 18 will make it a cinch to apply for installment loans issued by third-party lenders using your credit and debit cards.

Why Apple Pay Later is being discontinued

In March 2023, Apple Pay Later launched in prerelease mode but took until October to fully roll out. The service offered as much as $1,000 over four installments. But as the iPhone maker announced at the WWDC24 that third-party services from Affirm, Citigroup, and others would be integrated into iOS 18, Apple’s executives probably thought it might not be a good idea to compete with its partners on loans.

“Starting later this year, users across the globe will be able to access installment loans offered through credit and debit cards, as well as lenders, when checking out with Apple Pay,” the company said in a statement to 9to5Mac.

“With the introduction of this new global installment loan offering, we will no longer offer Apple Pay Later in the United States.” This change is already in effect.

“Our focus continues to be on providing our users with access to easy, secure and private payment options with Apple Pay, and this solution will enable us to bring flexible payments to more users, in more places across the globe, in collaboration with Apple Pay enabled banks and lenders,” reads the statement.

Our take: A change for the better

Apple Pay Later was never available outside the United States. According to Apple, third-party loans coming with iOS 18 will launch “in more places across the globe.”

Finally! Folks overseas won’t need to sell their kidney to buy the latest Apple product as installment loans will be a click away. Of course, your account will likely need to be in good standing, and Apple’s partner may reject a loan, but similar restrictions apply elsewhere.

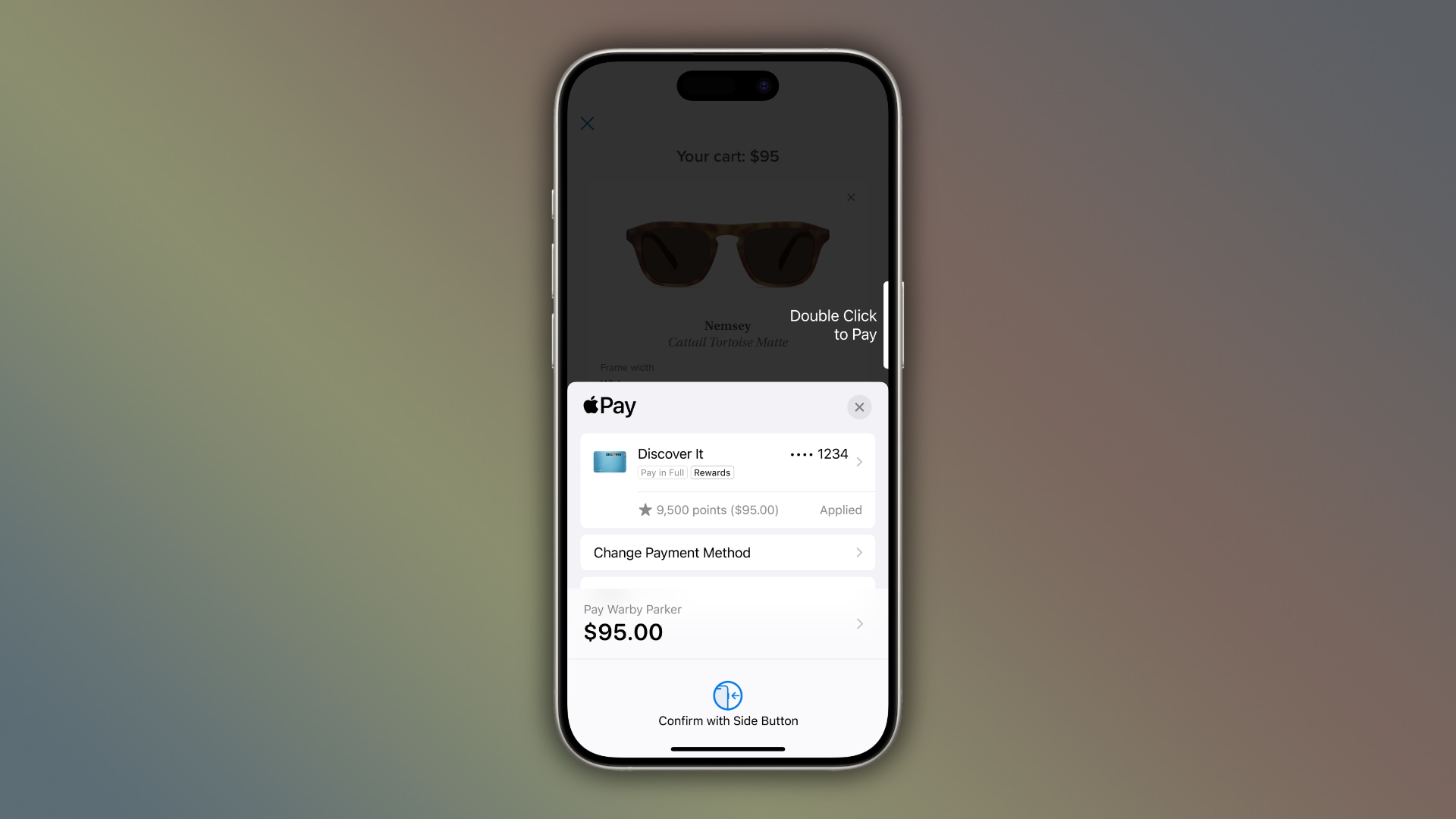

Apple Pay is getting rewards and third-party loans

iOS 18’s Apple Pay also supports viewing and redeeming rewards and points balances in the Wallet app. Redeeming rewards in Wallet will first launch in the United States with Discover and Synchrony, and across Apple Pay issuers with Fiserv.

As for installment loans, US customers will be able to apply for them directly through Affirm. Accessing installment loans in Wallet will first launch in Australia with ANZ, in Spain with CaixaBank, in the United Kingdom with HSBC and Monzo, in the United States with Citia and Synchrony, and across Apple Pay issuers with Fiserv.

As for installment loans, US customers will be able to apply for them directly through Affirm. Accessing installment loans in Wallet will first launch in Australia with ANZ, in Spain with CaixaBank, in the United Kingdom with HSBC and Monzo, in the United States with Citia and Synchrony, and across Apple Pay issuers with Fiserv.

Tap to Provision, Tap to Cash and more

iOS 18’s new Tap to Provision feature will let you add a contactless card to Wallet by tapping it to the back of your iPhone. iOS 18 enables Tap to Cash for direct money transfers via Apple Pay Cash by holding two iPhones together. This will let you pay someone back at dinner, for example, without sharing phone numbers.

iOS 18’s Wallet app features other notable improvements, such as redesigned and more informative tickets for events from participating ticket issuers.

iOS 18’s Wallet app features other notable improvements, such as redesigned and more informative tickets for events from participating ticket issuers.

And if you prefer third-party browsers, iOS 18 will let you use Apple Pay on third-party desktop browsers by scanning a QR code with your iPhone.

And if you prefer third-party browsers, iOS 18 will let you use Apple Pay on third-party desktop browsers by scanning a QR code with your iPhone.

Source link: https://www.idownloadblog.com/2024/06/18/apple-pay-later-shutting-down/

Leave a Reply