T-Mobile enters mobile banking with a new Money service

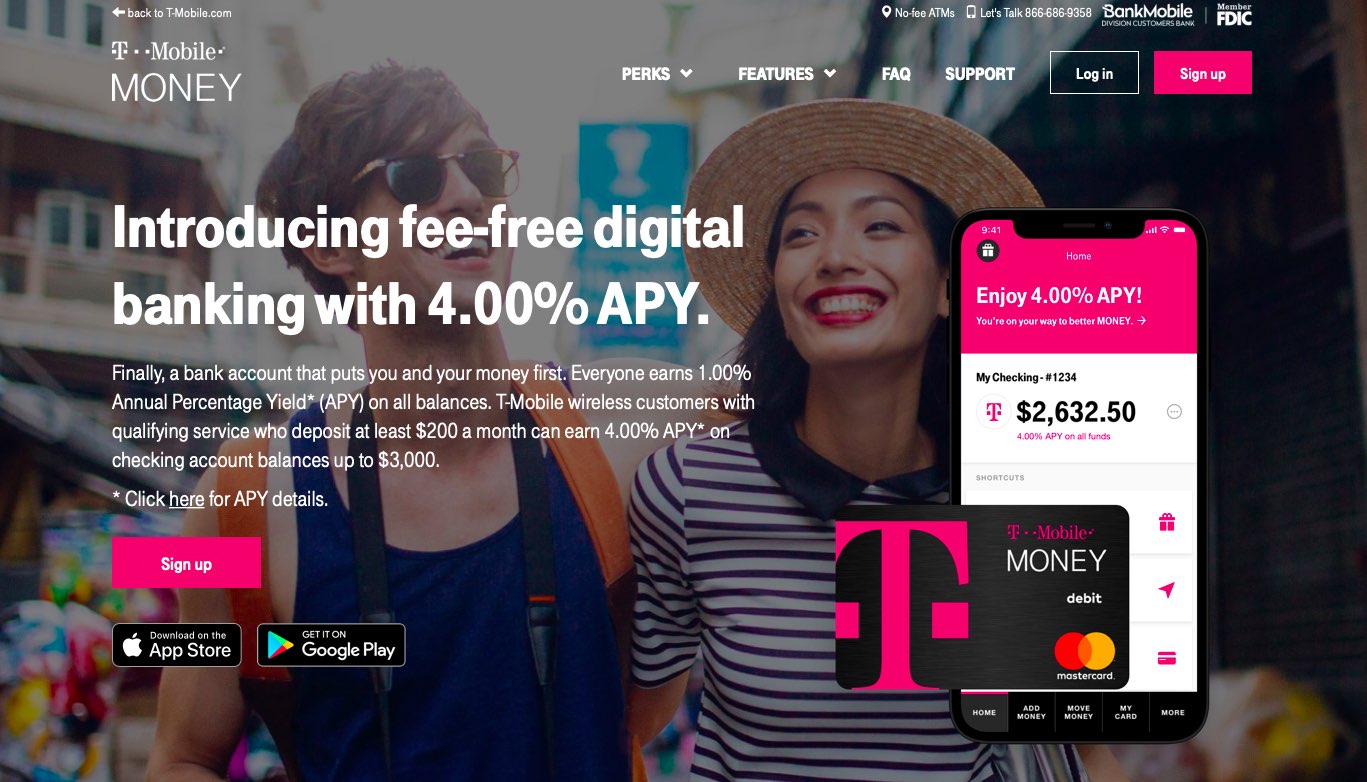

Wireless carrier T-Mobile on Wednesday quietly unveiled a mobile banking service of its own, T-Mobile Money, available as a free mobile app for iPhone and Android.

The service wasn’t officially announced but Domain Name Wire has discovered the official website at t-mobilemoney.com which went live today complete with T-Mobile branding and the full details. Mentions of the service were also added to Google Pay’s master list of US banks and credit card companies.

As part of T-Mobile’s typosquatting prevention plan, it yesterday registered more than 70 typos and variations of the t-mobilemoney.com and tmobilemoney.com domains, which Domain Name Wire thinks shows that the carrier is going big on this new service. The carrier promises no account fees, no maintenance fees and no minimum balances.

The accounts are operated by BankMobile, a division of Customers Bank, so T-Mobile Money works like your typical bank. The only major downside to T-Mobile Money is the lack of a simple way to deposit cash. “Instead, you’ll need to get a money order or cashier’s check and use mobile deposit, or deposit into another bank and move those funds to your T-Mobile Money account,” writes Google.

The pitch goes something like this:

T‑Mobile Money is the bank account that puts you and your money first. Everyone earns 1.00% Annual Percentage Yield (APY) on all balances and T‑Mobile wireless customers with qualifying service who deposit at least $200 a month can earn an industry-leading 4.00% APY on checking account balances up to $3,000.

This comes with some caveats so be sure to read the FAQ.

For instance, you earn the aforementioned APY yield on balances up to $3,000 each calendar month if you have a qualifying wireless plan, have registered for perks with your T‑Mobile ID and have deposited at least $200 in qualifying deposits to your checking account within the current calendar month.

“If you meet this deposit requirement in a given month we will pay you this benefit in the subsequent month as an added value provided all other requirements are met,” notes the carrier. Balances above $3,000 in the checking account earn 1.00% APY.

The digital finance service supports Google Pay from day one, but Apple Pay is not currently mentioned. However, T-Mobile Money’s branded MasterCard card does work with Apple Pay, Google Pay and Samsung Pay.

Other features include full access to bank accounts, including mobile deposits, an ATM locator, access to 55,000+ fee-free ATMs worldwide with the Allpoint ATM Network and more.

Here are the key features of the mobile app:

- Pay the way you want. Your T‑Mobile Money account includes a debit card with EMV chip, plus it works with Apple Pay.

- Hassle-free mobile banking. Easily transfer money to and from your external accounts for free. Send a check, pay bills, or direct deposit a portion or all of your paycheck to your account – all with just a few taps in your T‑Mobile Money app.

- Stay connected to your money. Access your money anytime with the app and enjoy 24/7 customer support.

- Safe and secure. Prevent unauthorized account access with multi-factor authentication. Log in with Touch ID and Face ID. Enable or disable your debit card remotely if it’s lost or stolen. Accounts are FDIC-insured up to $250,000. Plus, with Zero Liability Protection from Mastercard® you’re protected when fraud occurs.

The company’s mobile banking program for the unbanked, called Mobile Money, was phased out in 2016 so it seems that what we’re having here is a new initiative with a similar name.

T-Mobile Money is a free download from App Store.

Source link: https://www.idownloadblog.com/2018/11/28/t-mobile-money/

Leave a Reply